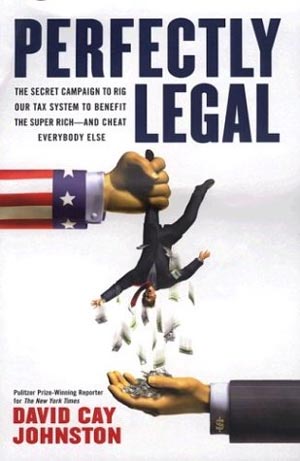

Perfectly

Legal

by

David Cay Johnston

Portfolio / 2003 / $25.95

The

most

important book to be published in the last several years

is not on sex, drugs, or rock 'n' roll, but on taxes.

That's

right: taxes.

David

Cay Johnston knows taxes: He's won one Pulitzer, and been nominated

for several more, for writing about them for the New York Times.

We all know, instinctively, that the system is screwing us, but

Johnston tells us how exactly we're being screwed in clear, comprehensible,

everyday language that anyone can understand.

Taxes,

when you think about it, are inevitable—as explained by Oliver

Wendell Holmes, they are the price we pay to live in a civilized

society. This is a risky proposition to state in an Internet publication:

The latest result of the American penchant for small government

and don't-tread-on-me-ism is a breed of online libertarian who believes

that the world will be perfect if the government would just go away

and leave him alone.

Yet,

the Internet itself could not have come about if not for government

grants; it came out of ARPAnet, a product of the Cold War-era desire

for a decentralized communication system. Modern people are no more

capable of living independently of one another than my finger could

if I sliced it off my hand. American individualism aside, we are

no longer Kit Carsons, living on the edge of the wilderness, wearing

the skins of the animals we shoot for food. No individual or corporation

can afford to, or should be trusted with, the maintaince of roads,

law enforcement, and other such necessary institutions. Like it

or not, from Mesopotamian kings directing the storing of grain against

famine years to our modern Social Security system, all human civilization

is to some degree socialist—and so, taxes are a necessary evil.

More

importantly, in Johnston's view, they are a way to examine our entire

economy. Perfectly Legal makes it clear that our supposedly

meritocratic, equal system is nothing of the sort. To read Johnston's

book is to be outraged. It is immediately apparent that there are

two castes in our country: Those of us who labor for wages, and

those well-off individuals who live off a pool of assets. Moreover,

from trust funds to offshore banks, corporations and the superrich

have ways of hiding their income that are not open to us. Nor are

they satisfied with what they have: The pressure to artificially

inflate stock prices by doing more with less is what is driving

the Wal-Martization of our economy. (It has also resulted in my

being laid

off two Christmases in a row.) The losers are employees,

small stockholders, and taxpayers who are unwittingly bankrolling

the personal use of company jets.

The Bush

administration has compounded all this by granting its corporate

allies policy advisor status. The supposed promises of "tax

relief" and $300 checks are lies and propaganda of the rankest

sort. Literally billions of dollars of tax breaks are given to the

wealthy and the corporations. Thus, our mounting budget deficit

and the burden of taxes being shifted onto the middle- and lower-class.

Johnston's anger at this fact is palpable and, after reading this

book, yours will be, too.

Interestingly,

Johnston does not blame the faceless government bureaucracy for

the mess, as most of us would be wont to do. Soviet Russia had a

most clear and fair system of laws; it was the administration that

was corrupt. The American bureaucracy, for all of our complaints

of the IRS, is, for the most part, fairly administered (though incidents

where laws are not equally applied to the rich and powerful do not

escape Johnston's examination). It is our tax code, passed by our

elected representatives, that is Byzantine. Reform must begin with

the tax code, and continue until all Americans (and corporations

doing business in America) are paying their fair share of the burden.

With the billions that have escaped the system, we could easily

afford the social benefits that other countries take for granted

-- health care, a decent education, and retirement benefits.

Lest

anyone forget, 2004 is an election year. I, for one, would like

to see candidates asked some of the questions that David Cay Johnston

raises in Perfectly Legal.